The Inflation Reduction Act: The Largest Climate Bill Ever

Monday, September 1, 3:30 - 5:00 pm, Zoom Recording & Slides

MEETING RECAP

The Inflation Reduction Act is the most extensive climate bill ever, was signed in mid-August 2022, and was discussed in the September E&S TAG meeting. Thank you to those who joined us, and a huge thank you to our presenters, Brian Perkins, Senior Policy Advisor, Congresswoman Jackie Speier's Office, and Jared Johnson, Policy and External Relations Senior Manager, Acterra. Provided much valuable insight into how the new bill would affect your local communities.

Overview

It is important to remember that San Mateo is very vulnerable and is in fact the most vulnerable county in California to the effects of sea level rise, where 40 percent of the county will be affected by 2100. OneShoreline is the special district whose purpose is to aid local agencies in dealing with climate change and sea level rise. We first had Senior Policy Advisor from Congresswoman Jackie Speier's office, Brian Perkins, illustrate the bigger picture of the Inflation Reduction Act (IRA) and then break down for us each significant provision connected to climate change and energy.

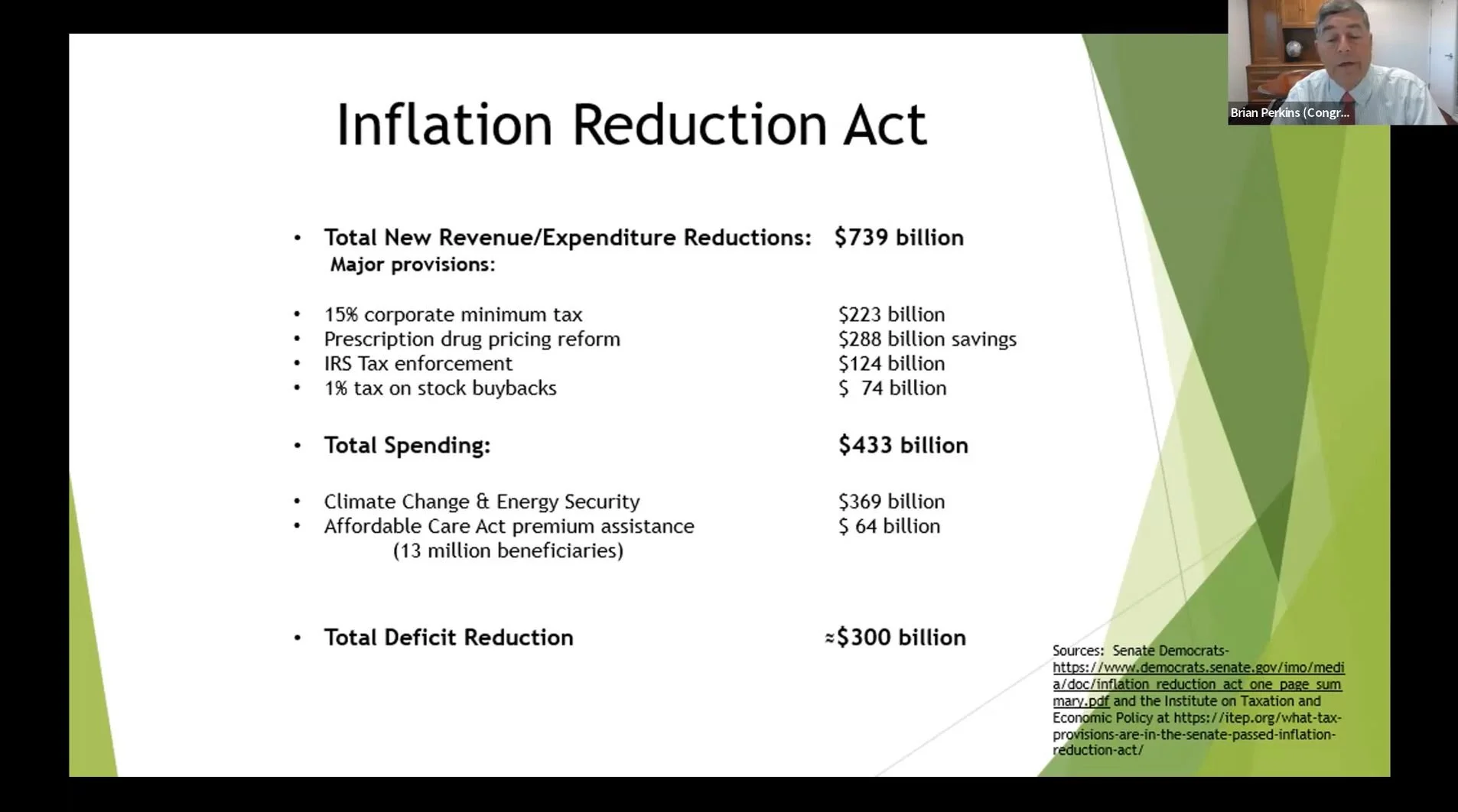

The bill will dedicate $739 billion to major provisions over the next ten years. Most of the bill's spending is dedicated to climate change and energy. The $369 billion is dedicated to this portion of the bill, which covers provisions like consumers, electric vehicles (EV), domestic manufacturing, methane and carbon emissions, and funds for disadvantaged communities. Perkins broke down the spending for each of these provisions and wrapped it up by giving examples of how this bill could affect us locally.

Consumer Provision

Most will be eligible for home energy rebates for electrifying homes with solar credits. That credit will last for ten years. In the past, it was for various lengths of time, but that will change. There is $9 billion for low-income households, and $8,000 credit is dedicated to heating pumps. There will be tax credits for EVs for lower and middle-income taxpayers.

EV Provisions

EVs constitute ~25% of all vehicle sales in San Mateo County, significantly more than the national average. Previously there were certain restrictions on purchasing an EV, for example, eliminating the restriction of credit to 200,000 vehicles for each manufacturer. Plug-in hybrids and hybrids credit are not coming back; this bill will only include EVs. Federal credit will extend to 10 years and be made available at the point of sale. The manufactured suggested retail price is what will be considered to get the credit. There is a $7,500 tax credit, for new conventional vehicles with a price cap of $55,000 or less, and a cap price of $80,000 for trucks/SUVs/vans. If you plan to buy a used car you will have the same price caps but a $4,000 tax credit.

Manufacturing Industry Provisions

Apart from the various credit payments, a considerable loan program isn't counted as spending—making the government $350 billion over decades. Now industries can use these loan programs update tools and infrastructure to build batteries and converting factories from conventional to EV. One significant way we will see benefits in California is with the nuclear plant by prolonging its life. They anticipate getting $1.5 billion to help PG&E extend it through 2030. They will also use fund to convert old fossil fuel plants to green energy, like the one in Moss Landing. The new electric generating plant's perimeter looks the same, but the "guts" of the plant have been taken out, and are now a stack of batteries. Solar energy is being stored at Moss Landing. The new tax credit will encourage advanced manufacturing in the US.

Methane and Carbon Provisions

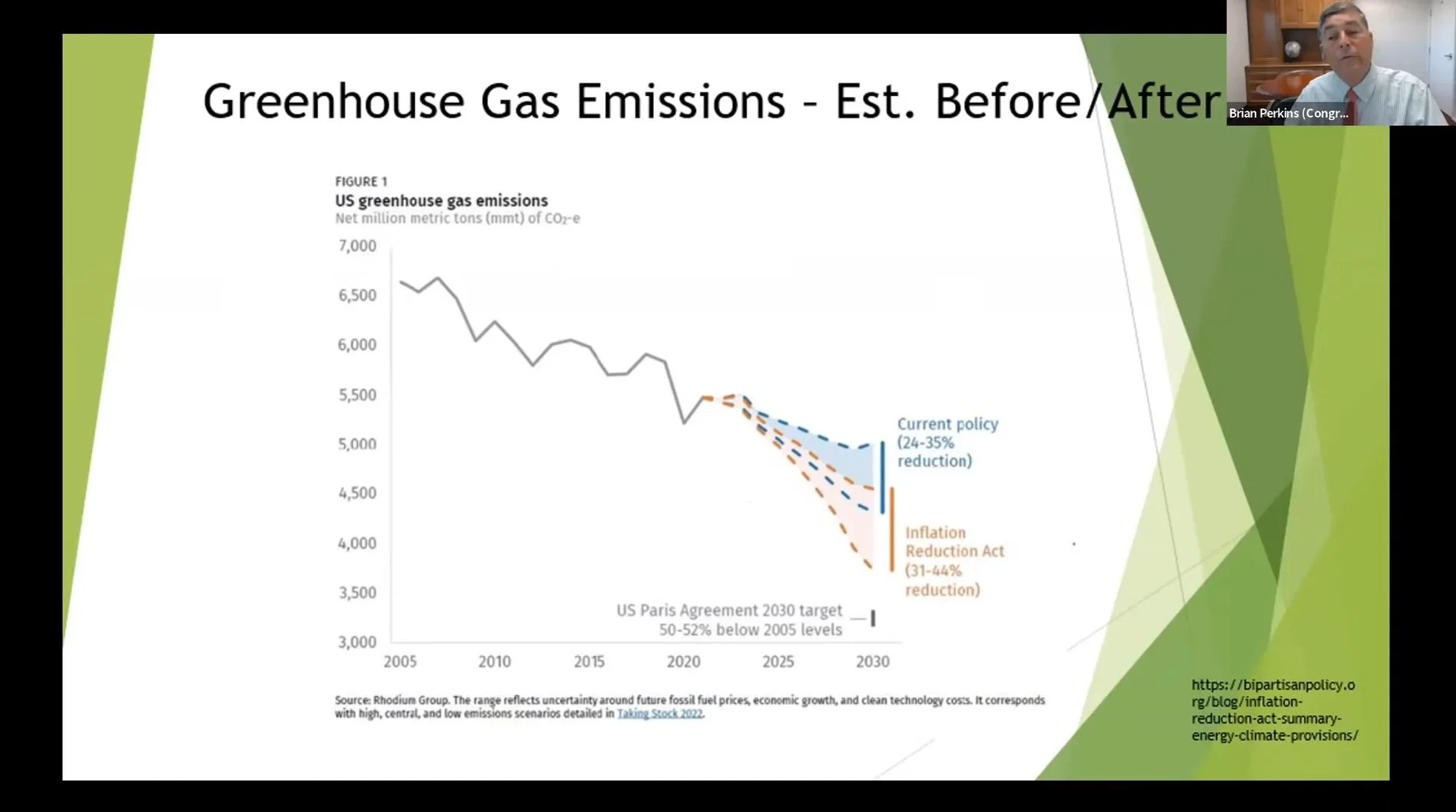

The first-ever methane fee that penalized the oil and gas industries for lack of emission control will be $900 per metric ton of emissions, increasing to $1,500 after two years. The federal government is encouraging these industries to "clamp down," as Brian Perkins stated. He shares a graph indicating prediction on the current policy effect on greenhouse gas emissions versus after the implementation of the IRA bill showing a 31- 44% reduction in greenhouse gas emissions by 2030.

Local Impacts

It is no secret that San Mateo County has taken the initiative in the EV and battery space from research to actual implementation. The local impacts the bill could have will continue to work and research and development of electrifying the county. Some examples of changes coming could be charging infrastructure development, transitioning from gas to all electric appliances, and establishing programs to strengthen the clean energy workforce. Jared Johnson, Policy and External Relations Senior Manager from Acterra presented on "What is Next?" Given that there are still some questions, it is necessary to continue educating the community on how the bill will roll out its tax and rebate incentives. How different sectors in the county utilize the bill's incentives will determine long-term impacts. Johnson encourages three points to make sure the bill impacts your community positively:

Education on taxes and rebates.

Build awareness among constituents and policymakers.

Provide services that make it accessible for everyone to access the bill's incentives.